Listen up, folks! If you're reading this, chances are you're either knee-deep in student loans or trying to avoid the trap altogether. Yep, student loans are one of those life-altering decisions that can either set you up for financial freedom or leave you drowning in debt. But don't worry, we’ve got you covered. In this guide, we’ll break down everything you need to know about student loans, from the basics to advanced strategies for repayment.

Now, before we dive into the nitty-gritty, let’s get real for a sec. Student loans are not just some random numbers on a piece of paper. They’re a commitment, a responsibility, and honestly, a bit of a headache. But hey, knowledge is power, right? By the time you finish this article, you’ll feel like a financial wizard ready to tackle those loans head-on.

Whether you’re a recent grad, a parent helping out, or someone looking to refinance, this guide is your go-to resource. We’ll cover everything from understanding the types of loans to smart repayment strategies. So, grab a cup of coffee, get comfy, and let’s unravel the mystery of student loans together.

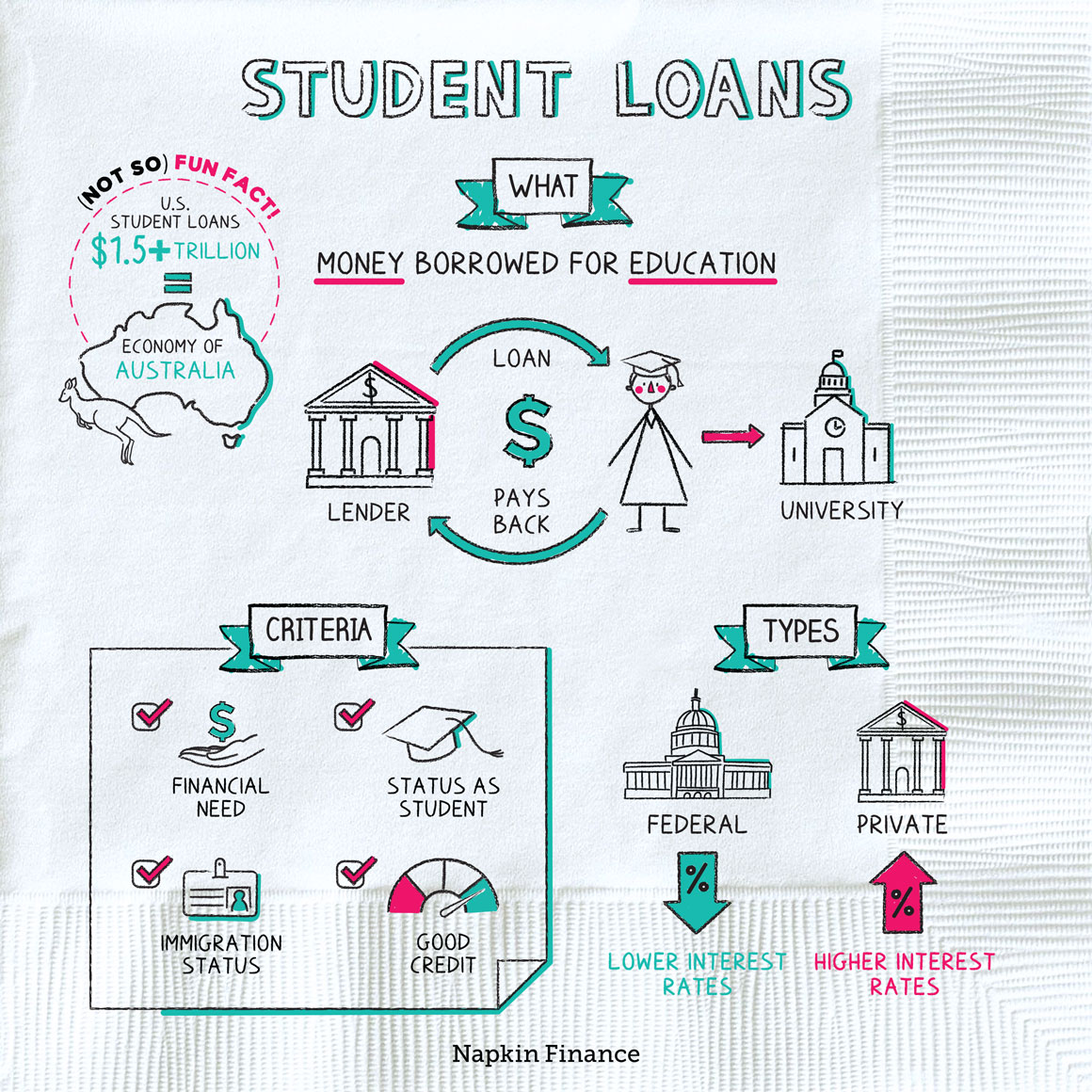

What Are Student Loans? A Quick Overview

Alright, let’s start with the basics. Student loans are essentially borrowed money designed to help students pay for their education and related expenses. Think tuition fees, books, housing, and even groceries. Sounds simple enough, right? But here’s the kicker—these loans come with interest, which means you’ll end up paying back more than you borrowed.

Why Do People Need Student Loans?

Here’s the deal: college ain’t cheap. According to recent data, the average cost of tuition and fees for the 2022–2023 school year was $10,740 for in-state students at public colleges and a whopping $38,180 for private colleges. That’s a lot of dough! And let’s not forget about living expenses, which can add thousands more to the bill. So, unless you’ve got a trust fund or a part-time job paying crazy wages, student loans might be your only option.

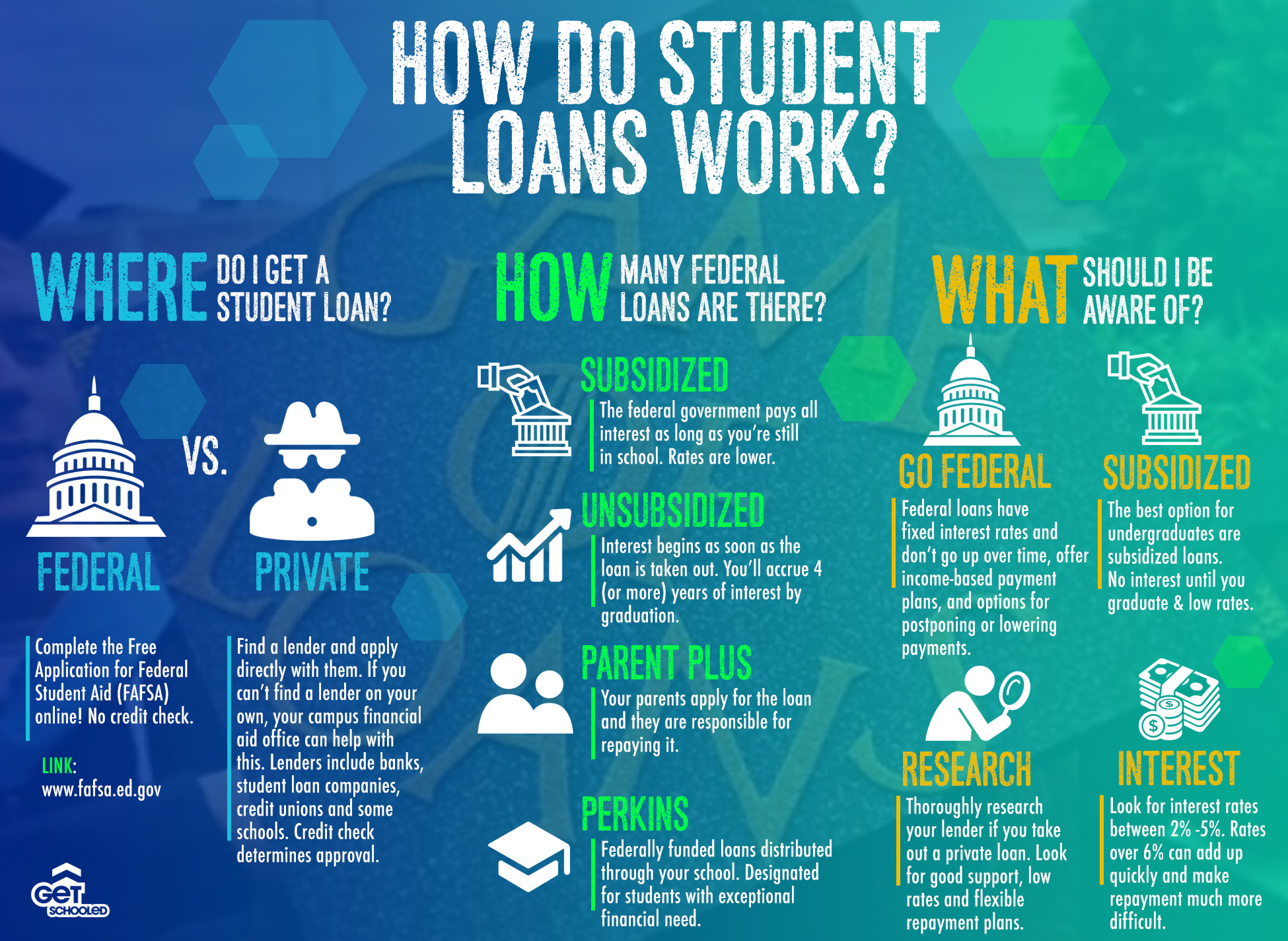

Types of Student Loans

Not all student loans are created equal. There are two main types: federal loans and private loans. Let’s break them down:

- Federal Loans: These are backed by the U.S. government and usually offer lower interest rates and more flexible repayment options. Examples include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans.

- Private Loans: These are offered by banks, credit unions, and other financial institutions. While they might have higher interest rates and less flexibility, they can be a good option if you’ve maxed out your federal loans.

Understanding the Costs of Student Loans

Now that we know what student loans are, let’s talk about the costs. Sure, borrowing money sounds great when you’re drowning in tuition bills, but the real impact hits when it’s time to pay back. Here’s what you need to consider:

Interest Rates: The Silent Killer

Interest rates are basically the price you pay for borrowing money. For federal loans, the interest rate is fixed, meaning it won’t change over the life of the loan. As of 2023, the rates range from 4.99% to 7.54%, depending on the type of loan. Private loans, on the other hand, can have variable rates, which means they can fluctuate over time.

Loan Fees: The Hidden Costs

Don’t forget about loan fees! Some loans come with origination fees, which are charged when the loan is disbursed. For federal loans, these fees range from 1.05% to 4.228%, depending on the loan type and when it was taken out. Private loans may also charge fees, so make sure to read the fine print.

How to Apply for Student Loans

Applying for student loans isn’t as scary as it sounds. Here’s a step-by-step guide:

Step 1: Complete the FAFSA

The Free Application for Federal Student Aid (FAFSA) is your ticket to federal loans, grants, and work-study programs. It’s basically a form that determines your financial need and eligibility for aid. Fill it out early, because some funds are awarded on a first-come, first-served basis.

Step 2: Compare Loan Options

Once you’ve completed the FAFSA, you’ll receive a financial aid offer from your school. This offer will outline the types and amounts of aid you’re eligible for. Take the time to compare your options and choose the loans that best fit your needs.

Step 3: Sign the Promissory Note

Before you receive your loan funds, you’ll need to sign a Master Promissory Note (MPN). This is a legal document that outlines the terms of your loan and your promise to repay it. Make sure to read it carefully before signing.

Managing Your Student Loans

Once you’ve taken out a loan, it’s time to manage it wisely. Here are some tips to keep you on track:

Track Your Loans

Keep a record of all your loans, including the lender, balance, interest rate, and payment due dates. You can use tools like the National Student Loan Data System (NSLDS) to track your federal loans.

Make Interest Payments While in School

If you have unsubsidized loans, the interest starts accruing as soon as the loan is disbursed. To save money in the long run, consider making interest payments while you’re still in school.

Stay Informed

Things can change, so it’s important to stay informed about your loans. Keep an eye on interest rate changes, new repayment options, and any updates to loan forgiveness programs.

Repayment Options for Student Loans

When it’s time to pay back your loans, you’ll have several options. Here’s a breakdown:

Standard Repayment Plan

This is the default plan, where you pay a fixed amount each month for up to 10 years. It’s great if you want to pay off your loans quickly, but the monthly payments can be high.

Income-Driven Repayment Plans

These plans base your monthly payments on your income and family size. They offer more flexibility and can lower your payments, but they may extend the life of the loan and increase the total amount you pay in interest.

Loan Forgiveness Programs

Depending on your career and circumstances, you might qualify for loan forgiveness programs. For example, teachers, public service workers, and military personnel may have part or all of their loans forgiven after a certain number of years.

Consolidation and Refinancing

If you’re struggling with multiple loans, consolidation and refinancing might be worth considering. Here’s how they work:

Loan Consolidation

Consolidation combines multiple federal loans into one, giving you a single monthly payment. It can simplify your repayment process and may lower your monthly payments, but it could also extend the life of the loan.

Loan Refinancing

Refinancing involves taking out a new loan to pay off existing loans. It can potentially lower your interest rate and monthly payments, but it usually means losing federal loan benefits like income-driven repayment plans and loan forgiveness options.

Dealing with Student Loan Defaults

No one wants to default on their loans, but it happens. If you’re struggling to make payments, here’s what you can do:

Rehabilitation

Loan rehabilitation allows you to get back on track by making a series of affordable payments. Once you complete the program, your loan is brought out of default status.

Consolidation

Consolidating your defaulted loan can also help. It combines your defaulted loan with other loans into a new loan, giving you a fresh start with a new repayment plan.

Seek Professional Help

If you’re overwhelmed, consider reaching out to a student loan counselor or financial advisor. They can help you explore your options and create a repayment plan that works for you.

Student Loan Statistics and Trends

Let’s take a look at some interesting stats and trends:

- As of 2023, there are over 45 million student loan borrowers in the U.S., collectively owing more than $1.7 trillion.

- The average student loan debt for the Class of 2022 was $39,400.

- Women hold nearly two-thirds of the total student loan debt in the U.S.

- Student loan default rates have been steadily decreasing, thanks to increased awareness and better repayment options.

Final Thoughts and Call to Action

So, there you have it—a comprehensive guide to student loans. From understanding the basics to managing and repaying your loans, we’ve covered it all. Remember, student loans don’t have to be a nightmare. With the right strategies and resources, you can take control of your financial future.

Now, here’s the deal: knowledge is power, but action is key. If you’ve learned something valuable from this article, don’t keep it to yourself. Share it with a friend, leave a comment, or check out our other articles on personal finance. Together, we can make student loans less intimidating and more manageable.

And hey, if you’re feeling overwhelmed, don’t hesitate to reach out for help. You’re not alone in this journey, and there are plenty of resources available to support you. So, take a deep breath, grab that coffee, and let’s tackle those loans one step at a time.

Table of Contents

- What Are Student Loans? A Quick Overview

- Why Do People Need Student Loans?

- Types of Student Loans

- Understanding the Costs of Student Loans

- Interest Rates: The Silent Killer

- Loan Fees: The Hidden Costs

- How to Apply for Student Loans

- Step 1: Complete the FAFSA

- Step 2: Compare Loan Options

- Step 3: Sign the Promissory Note

- Managing Your Student Loans

- Track Your Loans

- Make Interest Payments While in School

- Repayment Options for Student Loans

- Standard Repayment Plan

- Income-Driven Repayment Plans

- Loan Forgiveness Programs

- Consolidation and Refinancing

- Dealing with Student Loan Defaults

- Student Loan Statistics and Trends