Let’s talk about VIX, the Volatility Index, and why it’s a game-changer in the financial world. Imagine you're cruising through Wall Street like a pro trader, but suddenly the market throws a curveball your way. How do you prepare for that? Enter VIX, the so-called "fear gauge." It's not just a number; it's a lifeline for investors trying to navigate the choppy waters of the stock market. So, buckle up because we’re diving deep into what VIX is, how it works, and why it matters so much in financial markets.

You might be wondering, "What’s all the fuss about VIX?" Well, think of it as a crystal ball for financial uncertainty. It measures the expected volatility of the S&P 500 over the next 30 days. But here’s the twist—it doesn’t predict the direction of the market, just how much it might swing. That makes it an essential tool for anyone looking to hedge their bets or time their trades perfectly.

Now, let’s get one thing straight: VIX isn’t just for seasoned pros. Whether you’re a newbie or a seasoned investor, understanding this index can give you an edge. By the time you finish reading this guide, you’ll know how to use VIX to your advantage, spot market trends, and even protect your portfolio from unexpected turbulence. So, are you ready to unlock the secrets of VIX? Let’s go!

What is VIX and Why Should You Care?

VIX, short for the Volatility Index, is more than just a number on a screen. It’s a real-time measure of how much the market expects the S&P 500 to move in the next month. In simpler terms, it’s like a weather forecast for the stock market. If VIX is high, expect storms ahead. If it’s low, smooth sailing. But why should you care? Because VIX can help you anticipate market swings, which is crucial for both risk management and strategic investing.

Here’s the kicker: VIX isn’t just a barometer of fear. It’s also a reflection of investor sentiment. When markets are calm, VIX tends to be low. But when panic sets in, VIX spikes. This makes it a valuable tool for gauging market emotions and adjusting your investment strategy accordingly. Plus, it’s not just for stocks. VIX can influence everything from options trading to asset allocation.

So, how does it work? VIX is calculated using the implied volatility of S&P 500 options. This means it takes into account the prices of options contracts to estimate how much the market expects the S&P 500 to fluctuate. It’s a complex process, but the result is a single number that tells you a lot about market expectations. And that, my friend, is why VIX is such a big deal.

How Does VIX Impact Financial Markets?

Now that you know what VIX is, let’s talk about its impact. VIX doesn’t just sit there; it actively influences how financial markets behave. When VIX rises, it often signals increased market volatility. This can lead to increased trading activity as investors rush to protect their portfolios or capitalize on price swings. On the flip side, when VIX falls, markets tend to stabilize, and investors become more confident.

VIX also plays a key role in options trading. Traders use VIX to gauge the risk associated with options contracts. A higher VIX means higher premiums for options, reflecting the increased risk. This makes VIX an essential tool for options traders who rely on volatility to make informed decisions. And let’s not forget about hedging. Many institutional investors use VIX-related products to hedge against potential market downturns.

But here’s the thing: VIX isn’t just for traders. Retail investors can also benefit from understanding VIX. By keeping an eye on VIX levels, you can adjust your investment strategy to align with market conditions. Whether you’re looking to buy low and sell high or protect your portfolio from market volatility, VIX can be your trusted guide.

Understanding Volatility: A Deeper Dive

Volatility is at the heart of VIX, so let’s break it down. Volatility refers to the degree of variation in the price of a financial instrument over time. High volatility means big price swings, while low volatility indicates stability. But why does volatility matter? Because it affects everything from stock prices to bond yields.

There are two main types of volatility: historical and implied. Historical volatility looks at past price movements, while implied volatility, which VIX measures, focuses on future expectations. This distinction is crucial because it allows investors to anticipate market behavior rather than just reacting to it.

Volatility isn’t all bad, though. While high volatility can be risky, it also creates opportunities for profit. Traders often use volatility as a signal to enter or exit positions. By understanding volatility, you can make more informed decisions and potentially increase your returns.

Key Drivers of Volatility

What drives volatility in the first place? Several factors come into play:

- Economic indicators: Data like GDP growth, unemployment rates, and inflation can impact market sentiment and, consequently, volatility.

- Political events: Elections, policy changes, and geopolitical tensions can all influence market stability.

- Central bank actions: Interest rate decisions and monetary policies can create ripples in the financial markets.

- Corporate earnings: Company performance and earnings reports can drive stock prices and volatility.

Understanding these drivers can help you anticipate changes in VIX and adjust your strategy accordingly. It’s like reading the tea leaves of the financial world.

VIX as a Fear Gauge: Myth or Reality?

VIX is often called the "fear gauge," but is that title justified? The short answer is yes. VIX tends to spike during times of market uncertainty, which is why it’s seen as a measure of fear. But here’s the thing: VIX doesn’t just measure fear. It measures volatility, which can stem from both fear and optimism.

Think of it this way: when markets are uncertain, investors become cautious. They start buying options to protect their portfolios, driving up the price of those options and, consequently, VIX. But when markets are optimistic, investors might still buy options to capitalize on potential gains, also affecting VIX. So, while VIX can indicate fear, it’s not the whole story.

That said, VIX is still a powerful tool for gauging market sentiment. By monitoring VIX levels, you can get a sense of how investors are feeling about the market. And in the world of finance, sentiment can be just as important as fundamentals.

Using VIX for Strategic Investment

Now that you understand VIX, let’s talk strategy. How can you use VIX to enhance your investment approach? One way is through hedging. By buying VIX-related products, such as ETFs or futures, you can protect your portfolio from market downturns. This is especially useful during times of high volatility.

VIX can also help you time your trades. When VIX is high, it might be a good time to sell risky assets and move into safer ones. Conversely, when VIX is low, you might consider taking on more risk. But remember, timing the market is tricky, so always do your research and consult with a financial advisor if needed.

Another strategy is to use VIX as a sentiment indicator. If VIX is rising, it might signal a potential market correction. On the other hand, a falling VIX could indicate a bullish trend. By incorporating VIX into your analysis, you can make more informed decisions and potentially improve your returns.

Popular VIX-Related Products

Here are some popular VIX-related products you might consider:

- VIX futures: These allow you to bet on future VIX levels without owning the underlying index.

- VIX ETFs: These track VIX futures and offer a convenient way to gain exposure to volatility.

- VIX options: These give you the right, but not the obligation, to buy or sell VIX at a certain price.

Each of these products has its own risks and rewards, so choose wisely based on your investment goals and risk tolerance.

Historical Insights: VIX Over Time

Looking back at VIX’s history can provide valuable insights. VIX was introduced in 1993 by the Chicago Board Options Exchange (CBOE) and has been a staple of financial markets ever since. Over the years, VIX has seen its share of ups and downs, reflecting the ever-changing nature of the market.

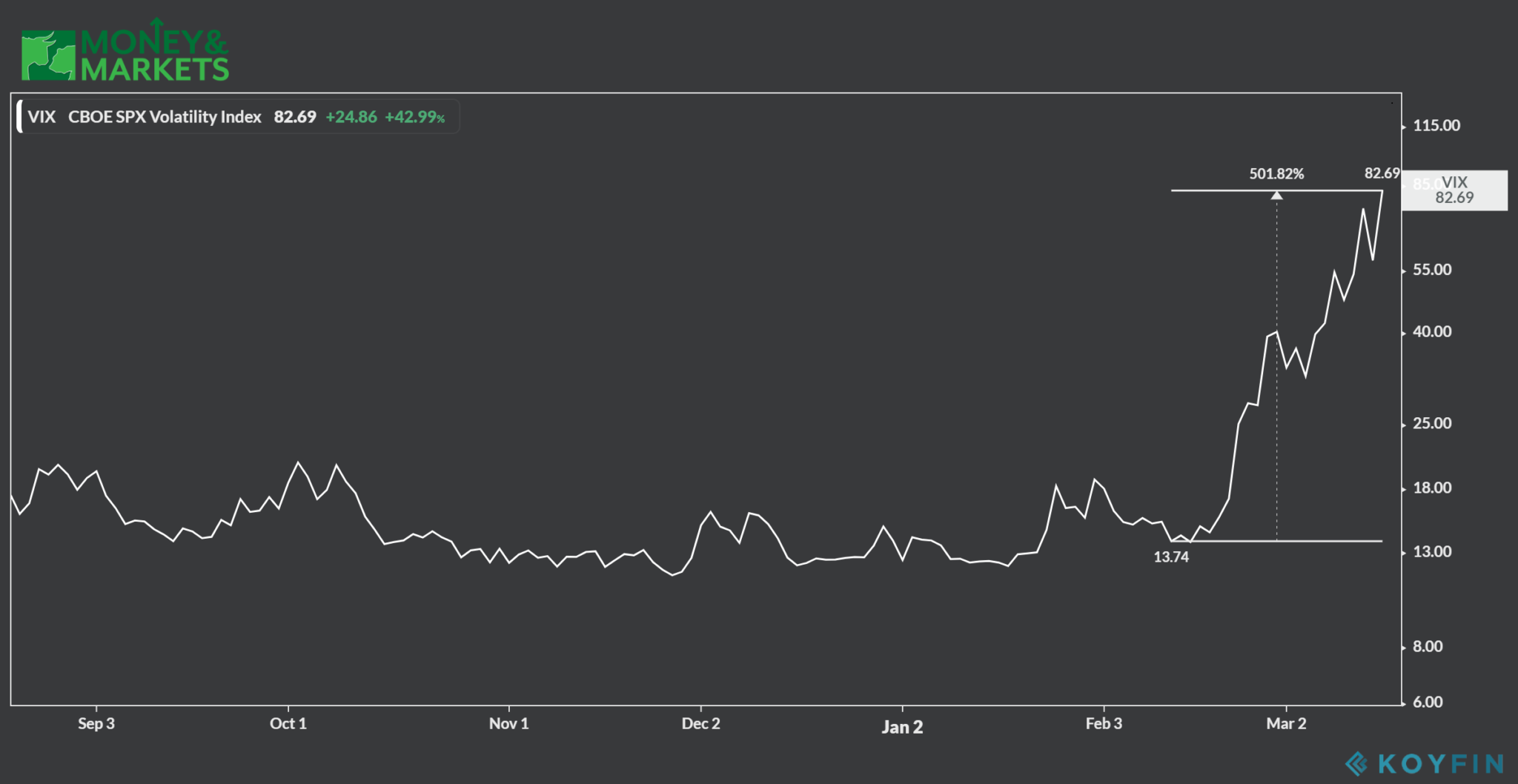

One notable period was the 2008 financial crisis, when VIX reached an all-time high. This spike reflected the extreme uncertainty and fear that gripped the market during that time. Similarly, during the 2020 pandemic, VIX surged as investors grappled with unprecedented market conditions.

But VIX isn’t just about the big events. It also provides insight into everyday market dynamics. By studying VIX’s historical patterns, you can gain a better understanding of how markets behave under different conditions and use that knowledge to your advantage.

Common Misconceptions About VIX

There are a few misconceptions about VIX that are worth addressing. First, VIX isn’t a predictor of market direction. While it can indicate volatility, it doesn’t tell you whether the market will go up or down. Second, VIX isn’t a one-size-fits-all solution. Different investors use VIX in different ways, depending on their goals and strategies.

Another common misconception is that VIX is only useful for traders. While traders certainly benefit from VIX, retail investors can also use it to inform their decisions. Whether you’re a day trader or a long-term investor, VIX has something to offer.

Finally, VIX isn’t a get-rich-quick scheme. While VIX-related products can be lucrative, they also come with risks. Always do your due diligence and understand the potential downsides before diving in.

Expert Insights: What the Pros Say About VIX

What do the experts think about VIX? Many seasoned investors and analysts view VIX as an indispensable tool. They appreciate its ability to provide real-time insights into market volatility and sentiment. Some even consider VIX a must-have in their investment toolkit.

But experts also caution against over-reliance on VIX. While it’s a valuable indicator, it’s not the only factor to consider when making investment decisions. Other factors, such as fundamentals, technical analysis, and macroeconomic trends, also play a crucial role.

One thing the experts agree on, though, is that VIX can help you stay ahead of the curve. By monitoring VIX levels and understanding its implications, you can make more informed decisions and potentially improve your investment outcomes.

Final Thoughts: Embracing VIX in Your Investment Journey

So, there you have it: the ultimate guide to understanding VIX and its role in financial markets. VIX isn’t just a number; it’s a powerful tool that can help you navigate the complexities of the stock market. Whether you’re a seasoned pro or a newcomer, understanding VIX can give you an edge in your investment journey.

Remember, though, that VIX is just one piece of the puzzle. To be a successful investor, you need to consider a wide range of factors and strategies. But by incorporating VIX into your analysis, you can gain valuable insights into market volatility and sentiment.

Now it’s your turn. Take what you’ve learned and put it into practice. Monitor VIX levels, experiment with VIX-related products, and see how they fit into your investment strategy. And don’t forget to share your thoughts and experiences in the comments below. Who knows? You might just inspire someone else on their investment journey.

Table of Contents

- What is VIX and Why Should You Care?

- How Does VIX Impact Financial Markets?

- Understanding Volatility: A Deeper Dive

- VIX as a Fear Gauge: Myth or Reality?

- Using VIX for Strategic Investment

- Historical Insights: VIX Over Time

- Common Misconceptions About VIX

- Expert Insights: What the Pros Say About VIX

- Final Thoughts: Embracing VIX in Your Investment Journey

- Conclusion

Conclusion

In conclusion, VIX is more than just a number; it’s a lifeline for investors navigating the unpredictable world of finance. By understanding VIX and its implications, you can make more informed decisions and potentially enhance your investment outcomes. So, whether you’re a trader or